TECHNICAL ANALYSIS (by Intraday Dynamics)

Tracking the Ten Year Note

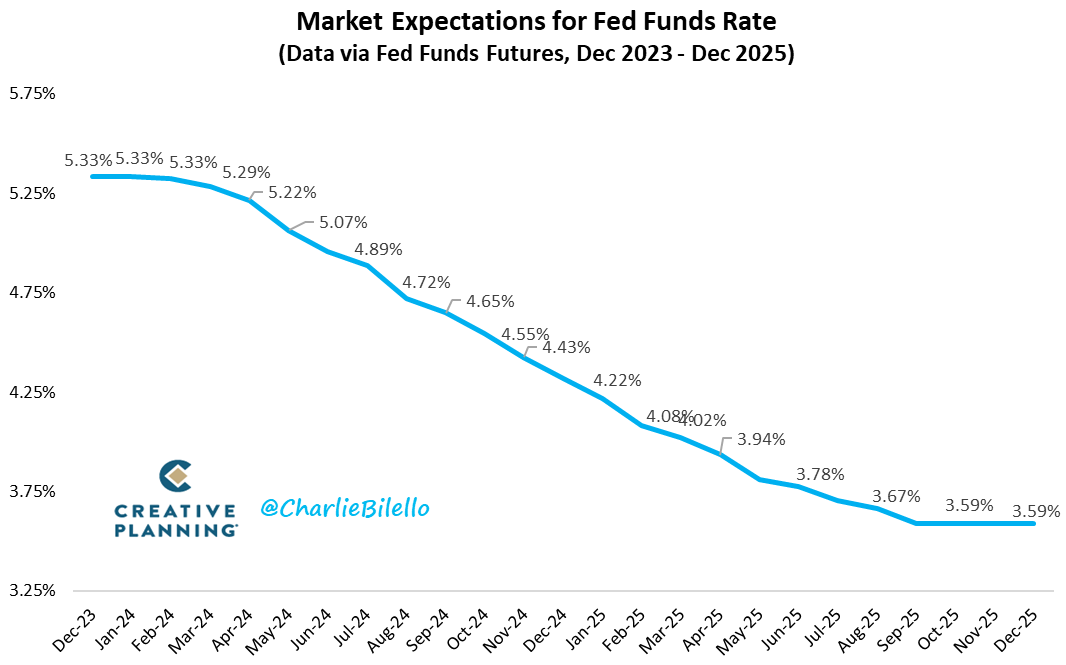

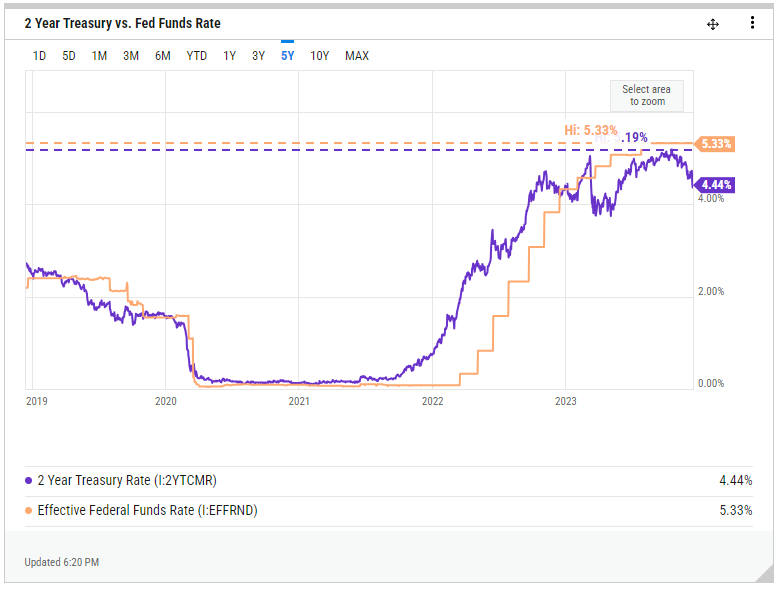

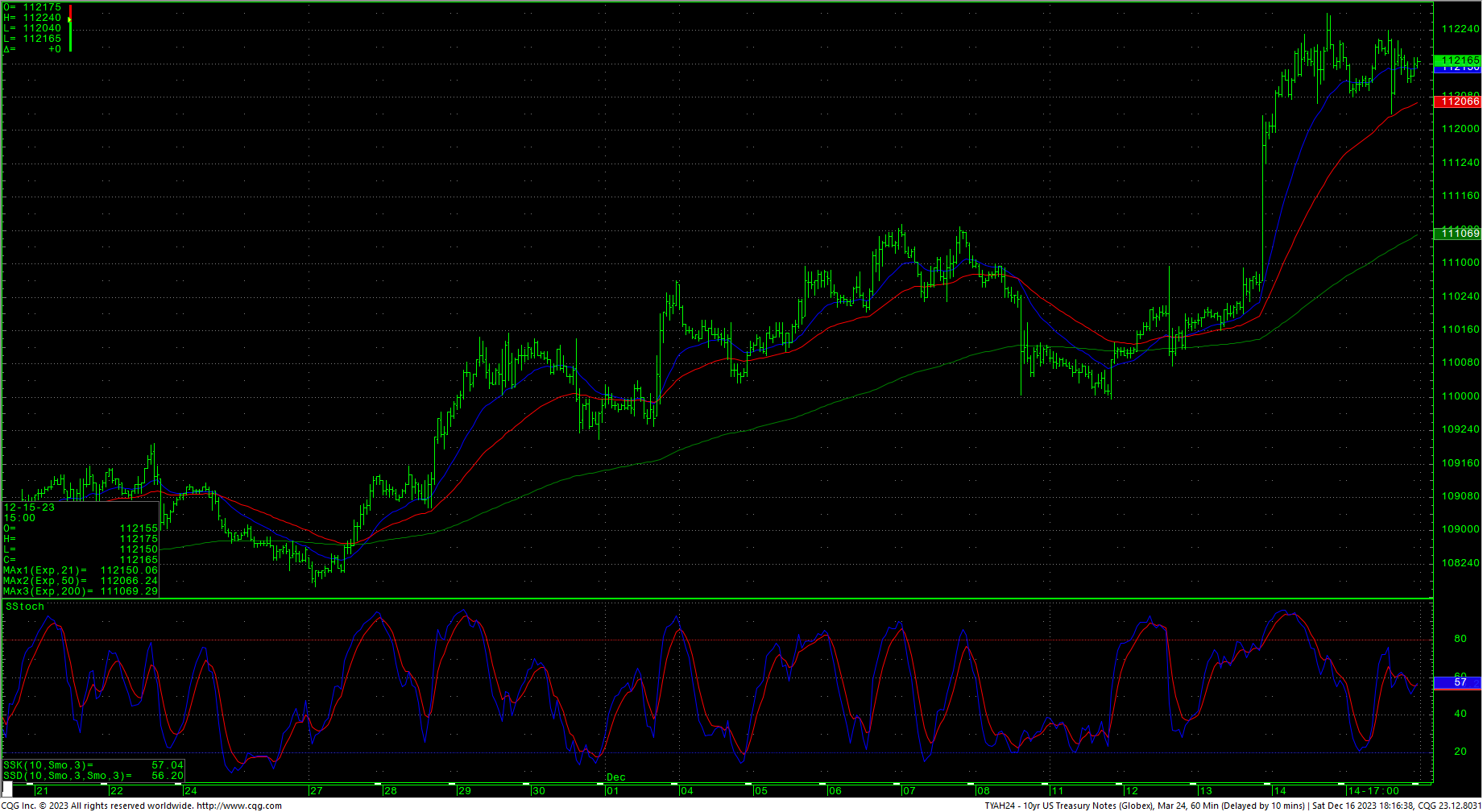

The 10-year Notes moved sharply higher last week on Fed news, driving the spot contract (DEC23) into pivotal short-term resistance. The weekly is working off deeply oversold conditions and the daily stochastics are hooking higher at a high level…flashing a preliminary bearish divergence if prices cannot continue higher. MAR24 is now top step and DEC goes off the board this week…so MAR24 will take over the spot continuation charts at a small premium. Therefore, translate all spot prices to MAR24 following this week.

The 10-year Notes moved sharply higher last week on Fed news, driving the spot contract (DEC23) into pivotal short-term resistance. The weekly is working off deeply oversold conditions and the daily stochastics are hooking higher at a high level…flashing a preliminary bearish divergence if prices cannot continue higher. MAR24 is now top step and DEC goes off the board this week…so MAR24 will take over the spot continuation charts at a small premium. Therefore, translate all spot prices to MAR24 following this week.

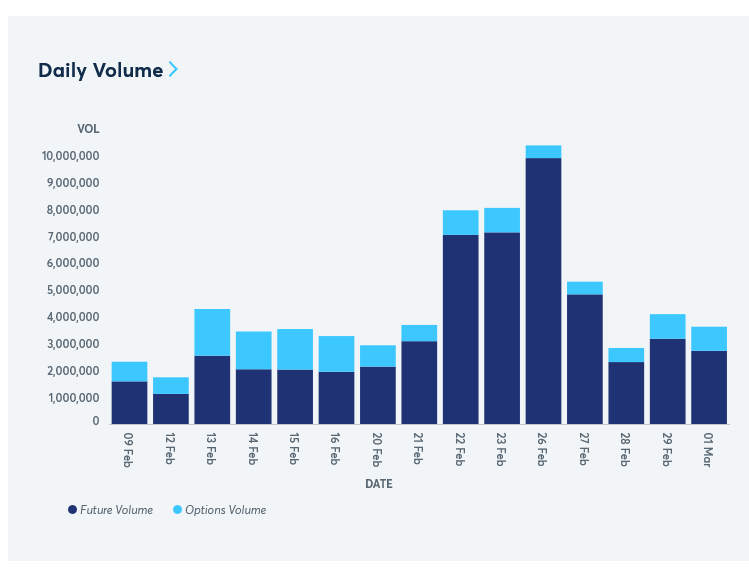

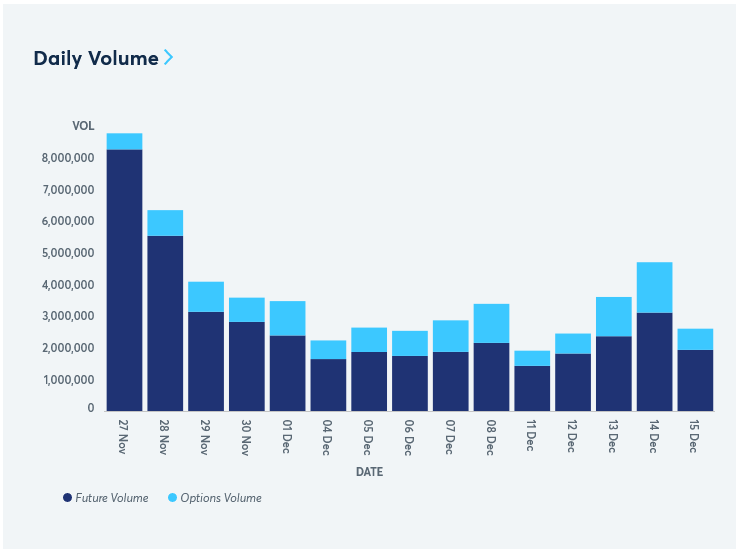

Ten Year Notes Futures Volume

Ten Year Notes Daily Continuation H-L-C

Ten Year Notes Weekly Continuation H-L-C

Resistance

- 112175/112250 *** ↑

- 113020 **

- 113065 *** ↑ TARGET

- 114075/114130 *** ↑

- 115030 **

- 115185 **

- 116160 ***↑

- 117000 *** ↑

Support

- 111055 **

- 110035 **

- 109080 ***

- 108135/108110 *** ↓

- 107110 ***

- 106110

- 105215 *** ↓

- 104050/104010 *** ↓

Charts courtesy of CQG, Inc, Bilello Blog and YCharts