TECHNICAL ANALYSIS

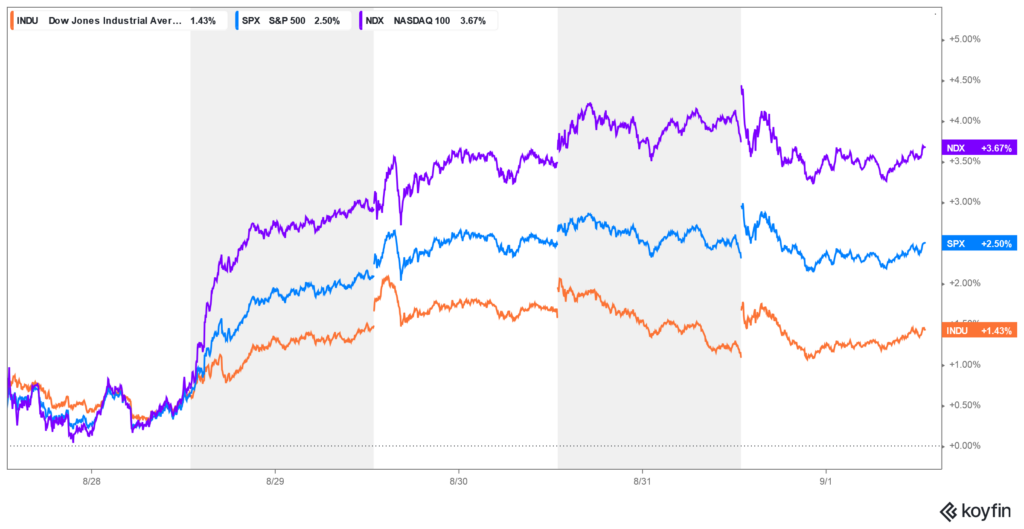

Major Indices Week of September 1, 2023

Timing Points

- 09/05 *** (end of tech decline?)

- 09/08 **

- 09/14 *** bonds

- 09/22 **

- 09-28 *** X extreme/fast moves

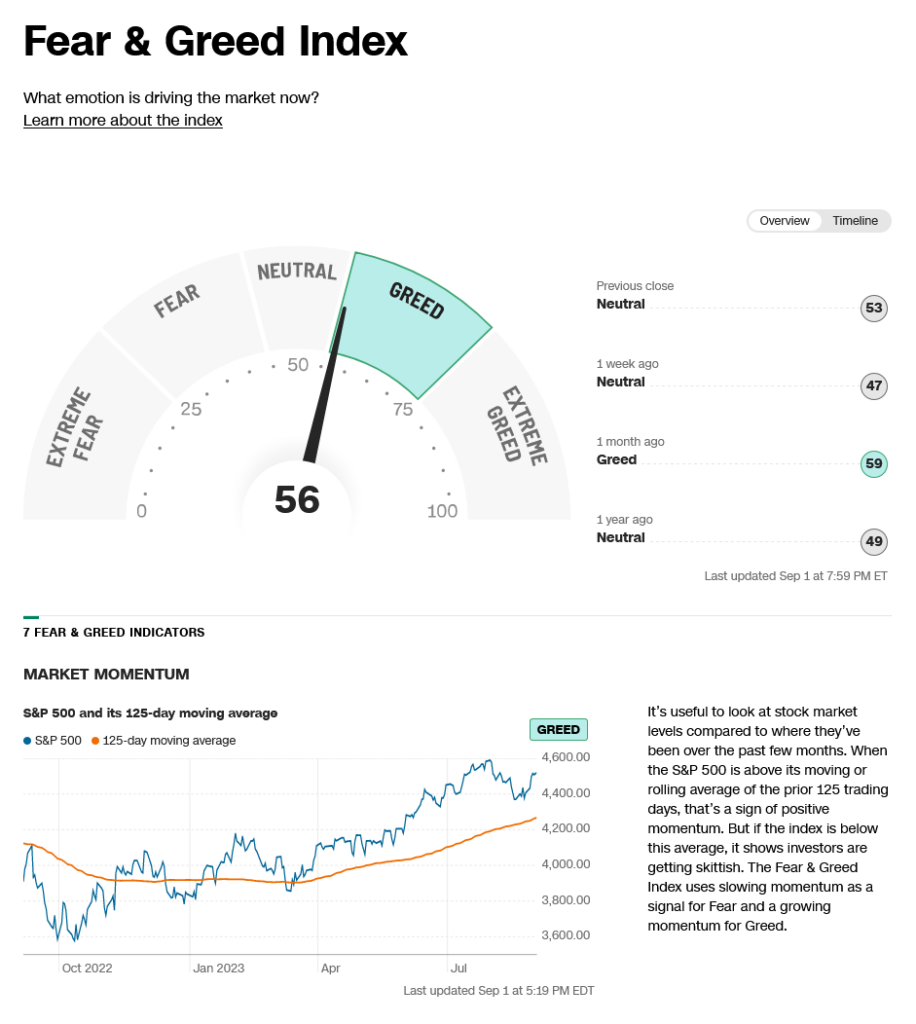

CNN Fear & Greed Index

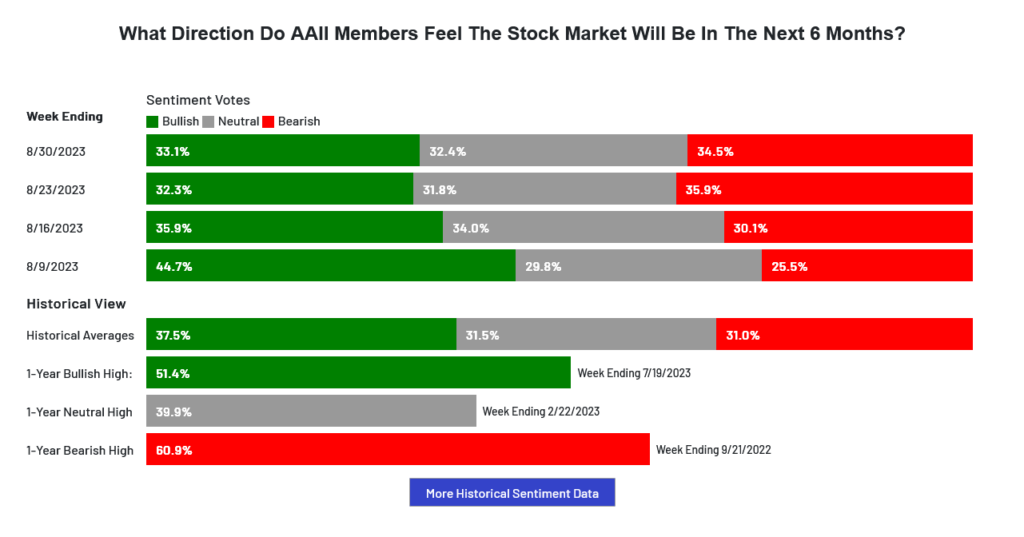

AAII Investor Sentiment Survey

AAII Investor Sentiment Survey

Dow Jones Industrial Average Hourly HLC

Dow Jones Industrial Average Hourly HLC

Resistance remains short-term pivotal at 35048/35055. Further rallies with closes over 35055 suggest a test of last-gasp resistance at 35266/35289. Closes above 35289 setup a test of the trading highs at 35679 with intermediate counts to 35824 and longer-term counts into a gap area on the daily at 35996 to 36044. A breakout over 36044 sets up the 36513 area with potential to test the all-time record highs at 36952. A reminder that the larger inverted H&S pattern on the DJIA weekly counts toward long-term targets at 37095.

Dow Jones Industrial Average Weekly HLC

- 34672 **

- 34549 ***

- 34426/34420 ***↓

- 34132 **

- 34020/34022 *** ↓

- 33865 **

- 33767/33760 *** ↓

- 33610 *** ↓

- 33537 **

- 33400/33399 *** ↓

- 33359 ** ↓

- 33316 ** ↓

- 33187 ** ↓

- 33091 *** ↓

- 32998 *** ↓

Resistance

- 34854 *** ↑

- 34941 **

- 35048/35055 *** ↑

- 35266/35289 *** ↑

- 35354 ** ↑

- 35432 **

- 35578 ** ↑

- 35670 *** ↑

- 35800/35824 *** ↑

- 35996 ***

- 36044 *** ↑

- 36271 **

- 36390 **

- 36513 ***↑

- 36636 **

- 36934/36952 *** ↑

- 37095/37096 *** ↑

S&P 500 Cash Index

The S&P hourly is bouncing from short-term oversold conditions and remains neutral. Prices cleared, and settled above, pivotal resistance at 4503/4510. Continued closes over 4510 setup a minimal test of 4550 and 4575. Closes over 4575 are bullish for a test of the swing high at 4607. Closes over 4607 suggest a minimal test of 4637. A breakout with closes above 4637 opens potential toward 4748 and ultimately 4818. Above the record highs opens counts to 4952/5000 with potential to 5144.

Support is 4462, 4438 and near-term pivotal at 4413/4410. Closes under 4410 should test 4328. A breakdown with closes under 4328 set up a move to 4180/4177. Closes under 4177 open counts to 4049 and critical short-term support of 3917/3910. Daily closes below 3910 open counts to 3754/3750 with potential to support at 3503/3491.

S&P 500 Index Weekly HLC

- 4462 **

- 4438 ***

- 4413/4410 ***↓

- 4380 **

- 4356 **

- 4335/4328 *** ↓

- 4304 **

- 4280 **

- 4261 *** ↓

- 4180/4177 *** ↓

- 4049 *** ↓

- 3917/3910 *** ↓

- 3875 **

- 3754/3750 *** ↓

- 3625 **

- 3500/3491 *** ↓

Resistance

- 4526/4527 **

- 4541 **

- 4550 *** ↑

- 4575 *** ↑

- 4593 **

- 4607 *** ↑

- 4637 *** ↑

- 4665 **

- 4748 *** ↑

- 4818 *** ↑

- 4952 ***↑

- 5000 *** ↑

- 5072 **

- 5144 *** ↑